For the last few years, we’ve been telling you about using the Section 179 tax code as a benefit to reinvest in your dental practice. As we’ve previously discussed, Section 179 was designed to provide significant tax relief. Equipment can be purchased, financed or even leased in some cases. Capital equipment purchases should always be cleared by your tax adviser to make sure they qualify.

For the last few years, we’ve been telling you about using the Section 179 tax code as a benefit to reinvest in your dental practice. As we’ve previously discussed, Section 179 was designed to provide significant tax relief. Equipment can be purchased, financed or even leased in some cases. Capital equipment purchases should always be cleared by your tax adviser to make sure they qualify.

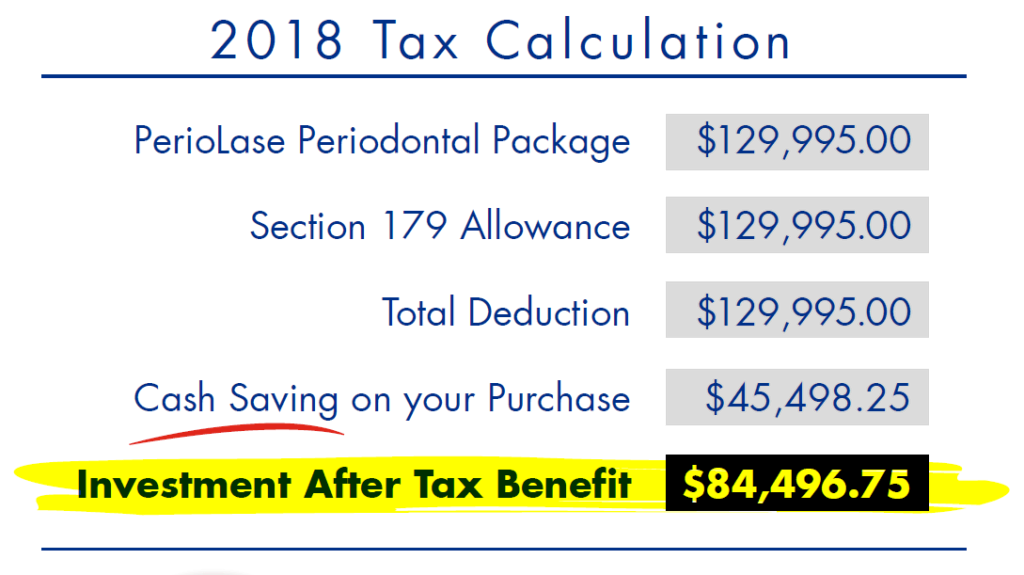

One such purchase is the PerioLase® Periodontal Package (PPP), which includes the PerioLase® MVP-7™ for the LANAP® protocol as well as the world-renowned Institute for Advanced Laser Dentistry training.

What’s Changed

For the 2017 tax year, Section 179 allowed for the deduction of the full price of qualifying purchases or financing of up to $500,000 from gross income. For 2018, that price ceiling has been raised to a robust $1 million.

Additionally, the calculations for the PPP have changed slightly (see figure below).

What Hasn’t Changed

Virtually everything else. Section 179 remains an excellent option for doctors interested in investing in a PerioLase, or even a second PerioLase (yes, second purchases do qualify as long as you are under the $1 million cap!) for those looking to expand their practices.

As with previous years, equipment must be purchased or financed and put into service by the end of the year (December 31, 2018) to qualify for Section 179. For those interested in applying Section 179 to the PPP, training sessions should be booked as soon as possible.

Undoubtedly, you will see many vendors touting their equipment as good contenders for a Section 179 write-off as the year draws rapidly to a close. While investing in technology can be a positive, forward-thinking step for any dental professional to take, it’s important to consider all the factors that will make a purchase a good one, with return on investment, ease of installation and use as well as its ability to help expand or improve the way you run your business.

Choose your technology investment wisely — and start saving big while growing your practice!

Want to calculate savings for yourself? Visit Section179.org to learn more and use the official Section 179 calculator.